Successful social and economic development of any country associated with existing investment funds. From investment resources at the current stage of particular importance are foreign investments. Today, no country in the world can not fully meet their industrial and consumer needs only its own resources, no matter how developed or were these countries. At the present stage it is contributed to a significant expansion of investment relations between the two countries, on the basis of deepening the process of integration of national economies.

At present, the acceleration of scientific and technological progress and expansion of innovation activities introduces the agenda of the further strengthening of the role and value of foreign investments. This is clearly valid the following fact: if, during the First World War, foreign investment accounted for only 10% of all investments by the end of the last century, their share has grown three times.[2;42]

At the present stage of globalization countries, both developed and developing economies and passing, are keenly interested in expanding foreign investment. It should be noted that most of the financial resources of the world are mainly concentrated in developed countries. Organizations and companies in these countries have a greater part of the global financial resources. In addition, foreign direct investment are growing very rapidly in world. Over the past 30 years of the last century they have increased from 100 billion to 6.8 trillion dollars, which indicates a deepening of the globalization of the world economy.

In Georgia, the need to attract foreign investment in the country is dictated formed unfavorable economic conditions: low economic growth, high unemployment and low living standards of people, non-existent for the involvement of the individual sectors of the economy means that are necessary for the creation of industrial and social infrastructure.[4; 108]

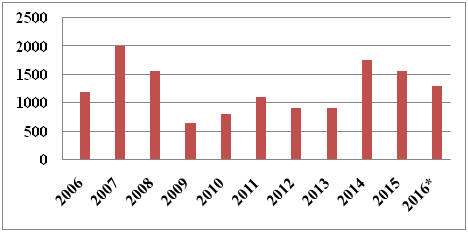

For the passed period of economic reform of important measures have been carried out in Georgia in order to attract foreign investment for its promotion, protection and creation of legal and regulatory framework. In consequence of these measures are implemented improvement of legislative and regulatory framework and improving the investment climate, so that the inflow of foreign investment has tended to increase, as can be seen in the figure 1.

The influx of foreign investment in Georgia is directly linked to the economic reforms in the country. At the initial stage of privatization of state property (1995-1996.), Georgian Foreign investment is practically not carried out (except for 3.753 million dollars Ukrainian investments).

Figure 1 . Direct Foreign Investment in Georgia during 2006-2016 (million USD)

* To Preliminary Data [1]

The influx of foreign investment in Georgia is directly linked to economic reforms conducted in the country. At the initial stage of privatization of state property (1995-1996.), Georgian Foreign investment is practically not carried out (except for 3.753 million dollars Ukrainian investments).

In 1997-1998 the flow of foreign investment in the country gradually increased, but in the subsequent period (until 2002) the figure was characterized by a trend of decline, which was due to the imperfection of the legal framework for investment, high levels of corruption, unstable political situation in the country and other.[5;118]

Since 2003 the flow of foreign investment in Georgia characterize trend in 2007 exceeded 2 billion figure USD. As for the next, 2008, the inflow of foreign investments in Georgia in comparison with the previous year, decreased by almost half a billion dollars, ie, by 23%, which was due to the well-known events of August 2008. The subsequent annexation of the territory of Georgia by Russia is much worsened the country’s investment image and, accordingly, reduced the volume of incoming investments in the country. In particular, in the third quarter of 2008, compared to the previous quarter, foreign investment decreased by 605.4 million up to 134.7 million dollars that is to 77.8%.

As a result of the efforts of the international community and the Government of Georgia, despite some increase in foreign investments in the fourth quarter of last year, and this year the figure has tended to decrease. In particular, the country has become 134 million in the first quarter of 2009, and in the second quarter — Only 92.2 million of foreign investments, overall incoming investments in the first half of 2009 amounted to 36.8% -a similar index of the first half of 2008, decreased by 2.7 or more.

Consider the recent years. According to the Georgian Department of Statistics, in 2013 the amount of foreign direct investment amounted to 914 million US dollars. In the previous year, 2012, the figure for the same period amounted to 912 million dollars. As you can see, in 2013 there is an increase of 2 million US dollars. It should be noted that in 2013, even more than on a quarterly basis in 2012 for investment performance. Despite the fact that each subsequent quarter of the year is considered to be more active than the previous one, kvartal2013 IV of the year it was economically the most passive. Similarly in terms of investment. For example, in the IV quarter of 2013 to 217 million. Dollars of direct investment was carried out, which is 7% less than the previous same period. [1]

The largest volume of foreign investments was recorded in the III quarter — 239 million US dollars, exceeding the prior-year period by 20%.. According to the II quarter 2013 index of investment over the same period of the previous, 2012 at 7%. However, investments made in the I quarter of 2013 amounted to 226 million.USD, which is 16% less than the same period last year.

According to the list of the largest investment data in 2016, invested in Georgia, leading countries such as the Netherlands — 20%; Luxembourg — 16%; China — 11%. They are followed by Azerbaijan — 10%; Turkey — 8%; USA — 6%, and other countries.

According to preliminary 2015 figures in 2016, the largest investments were made in the following sectors: energy — 198 million US dollars, accounting for 22% of all foreign investment;. financial sector — 170 million US dollars (19%). transport and communications — 138 million US dollars (15%). processing industry 124 million US dollars (13%), construction -. US $ 54 million (6%) and others.

It should be noted that the highest rate of foreign direct investment recorded in 2007, is 2.015 billion. USD which is 69.3% higher than the previous year as a whole. The high rate of investment was maintained in 2008, however, only until August. In 2012, Georgia’s foreign direct investment made by 912 million USD, which is 18% less than in 2011. According to preliminary data, in 2014 will exceed 2013 by 0.3% 5.

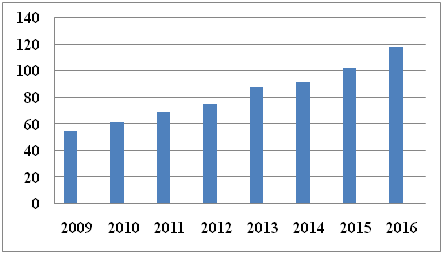

In parallel with the growth of foreign direct investment, the share of public investment in their total volume is reduced, with a corresponding increase in the volume of private investment, both in absolute and percentage terms. The consolidated budget of the 2013 acquisition of nonfinancial assets (which represents an investment by the State) amounted to 544.5 million GEL.[1]

According to the National Statistics Service: fixed capital formation during the same period amounted to 4 billion 193 million GEL. Accordingly, public investment in total investment amounted to about 13%, accounted for the private investments — 87%.

In 2012, the acquisition of nonfinancial assets amounted to 1 498 million GEL millird and fixed capital formation in general — 6 billion 496 million GEL. That means that in 2012 the total volume of investments carried out by the share of public investment was approximately 23%, respectively, private — 77%.

According to statistics, 2009-2012, as we have noted above, the share of public investment in their total volume decreased both in absolute gross and percentages. As you can see, this process continues today.

In the first quarter of 2013, a reduction of foreign direct investment led to a criticism of the Georgian Government by the opposition. For its part, the Government has drawn the attention of the opposition to the growth of investments in the second quarter of 2013 to 2016 inclusive.

Figure 3. Private Investment(in % to the Total Volume of Investments)[1]

In the fourth quarter investments dropped again. Eventually, in 2013, recorded an increase in foreign direct investment — is insignificant. Accordingly, as a result of the analysis of these data, we can not say the situation has improved or worsened in the field of investment.[6;38]

Analyzing all the above, we make the following conclusions:

- Not only incremented foreign investment, but with their increasing need to use them purposefully and efficiently. Data confirmed that by far the majority (46.5%) of the investment resource of the country is used to finance the public administration, the acquisition of assets of private and public, in order to provide community, social and personal services. And in the material production sectors, the level of use of such investments is very low. In the industry it is — 5,3%, in agriculture and forestry — 2.8%, construction — 5.3%. Also small share of investment used in the field of education (1.9%) and health (0.9%). To this we can add that most of the inflowing to the country’s financial and credit resources are used primarily to meet the needs of the consumer market instead of production of goods and in the area of social infrastructure, which, in fact, create real jobs and increasing employment opportunities population.

- At the present stage of development in Georgia, attracting investments is a vital prerequisite for economic and social reconstruction of the country and its further development. In this case, a decisive role to play to create a favorable investment climate and competent implementation of the investment policy. Growth of foreign investments should contribute to the country’s security and sustainable economic development, the creation of additional jobs, employment growth and reduce unemployment.

- Formation of a favorable investment climate in the country has its promoting and impeding factors. From contributing factors should be mentioned the fact that in spite of the small capacity of the country of the market, foreign investors still interested in investing in Georgia, because production on the territory of Georgia, he promises savings in production costs.

- The enabling environment in the country defines as the same excellent geographical location of the country — Georgia is a corridor, connecting Europe and Asia, it is connected with the global market by air, sea, land, rail, trunk and other means of communication. In addition, the country’s low competitive environment, low level of development of the manufacturing sector, which does not provide saturation of the domestic market its own production of goods and the satisfaction of consumer goods, competitive price. It is clear that in such circumstances, foreign investment is beneficial both for investors and for local consumers and the country.

- Despite the implementation of activities, which resulted in the simplicity of the Georgia business in the world today takes 11-th place in the formation of the country’s investment climate is still a lot of problems. First of all it concerns the stability of the macroeconomic environment. Despite its definite improvement in recent years, however, the country’s small GDP growth and growth of GDP per capita, Georgia is much smaller than those from many CIS countries. For example, per capita GDP in Russia — 3440 US dollars, in Belarus — 1580 in Ukraine — 820 US dollars, in Azerbaijan — 1760 US dollars, in Kazakhstan — 2670 US dollars, and in Georgia — only 780 USD.6. From the perspective of foreign investors, Georgia still belongs to high investment risk countries and this image was formed in the country for years. It is because the adjustment, change of image — an urgent and primary task of the Government of Georgia.

- Among the factors that affect the investment environment, are of particular importance level of the banking system and credit availability. In spite of the activities carried out in this direction in this area is still a lot of problems, of which it should be noted the scarcity of credit resources, high credit interest, the limited preferential loans and their inaccessibility. The Government and the National (Central) Bank of Georgia must take more care in obtaining soft loans from international financial organizations, the EU and other donor countries, which to some extent reduce the shortage of preferential credit resources and create conditions for the formation of optimal interest rate.

- At the same time, special attention needs to be improved and the rules on the distribution of foreign loans. We fully share the philosophy that in the long-term financing need those investment projects that are able to solve the problems identified by the strategy of the state social and economical investment. The most important factor in attracting investments and improvement of investment climate in the country is to improve the tax system. Despite repeated transformation tax rates to date in Georgia is still high, which causes fair discontent entrepreneurs. If we add to this endless inspections by state bodies of financial control and collection of taxes, it is clear that the problem is becoming more acute. Shortcomings exist in the field of taxation is a serious obstacle factor for the development of entrepreneurship and to attract foreign investment.

- For the formation of the investment environment seriously impeding factor is a certain level of corruption, which prevents the rational disposal and management of its own financial resources as entrepreneurs and foreign investors. In Georgia, the level fluctuates within 45-55%, but experts estimate the real figure is much higher. For comparison index developed countries: it is 10-30%.

- The most corrupt sphere in Georgia is considered to customs, where a high level of pass unregistered and counterfeit goods. Also high is the level of corruption in areas such as personal services and trade, which, in spite of a number of the measures (installation of cash registers, and so on.), Financial control is associated with many difficulties. The fight against corruption, to create a modern civilized conditions for business development, should be the strategic direction of public policy.

- To date, the country’s extremely low level of production efficiency, which makes it possible to enhance the process of creating capital and improve the performance of funds accumulation. This directly affects the increase in external debt. Today, Georgia’s foreign debt amounts to 3.3 billion. Dollars, that is, 1/4 of the country’s GDP. Service costs of such debt in an amount that is equal to almost half of the amount of investments in fixed assets. In this situation, the country’s development prospects in the future are uncertain. Correct position of the only possible way to attract foreign investment, for which it is necessary to radically improve the investment environment.

- In order to attract investment and smooth business development, it is necessary to improve the existing legal framework in the country and the judicial system. This will be an important factor of improvement of the investment environment. It is not uncommon, when, due to serious shortcomings in the system, investors have to go to different state authorities and incur additional costs. They often just demands are not met and the consideration and decision of cases transferred from the courtroom in the government structure, which is very unacceptable in a civilized society.

- The improvement of the investment environment of the country, increasing the volume of investment and efficient use of the active role given to government regulation, the development of proper investment policy and its smooth implementation. Such a policy should be based on a system of organizational measures, which should provide a solution to the long-term socio-economic problems of the state, continuous and unhindered economic growth, increasing employment by creating new jobs, reducing unemployment and, ultimately, growth of welfare of the population.

- The foreign investment promotion strategies should take into account the accompanying negative results. In particular, in the context of an acute demand for investment The government should not allow the market mechanism to turn the country into a resource appendage of foreign states. should be the preservation of Georgia last word in deciding on admission to the territory of foreign investors making the country and maintaining control over the individual spheres and sectors of the economy, where their investments have to be placed The main requirement of the investment strategy of our country. In our opinion, the only way possible to maintain economic and ecological independence and security of the country.

Conclusions

The improvement of the investment environment of the country, increasing the volume of investment and efficient use of the active role given to government regulation, the development of proper investment policy and its smooth implementation.

In attracting foreign investment strategies should take into account the accompanying negative results. In particular, in the context of an acute demand for investment The government should not allow the market mechanism to turn the country into a resource appendage of foreign states.

References

- The official website of the State Statistics Office of Georgia https://www.geostat.ge/

- Campos N.M., Kinoshita, Y (2002). «Foreign Direct Investment as Technology Transferred: Some Panel Evidence from Transition Economies». 41-42

- Baratashvili, Magrakvelidze D., Principles of investment environment improvement in the Georgia-TB., 2009. -P.152

- Datunashvili L., favorable investment environment — the basis of the country’s economic revival. See. Actual problems of economic development at the present stage. The collection of materials of scientific-practical conference of Georgian economists, December 25, 2008, TB. 2008,. -p 106-125

- Tetruashvili Z. Tetruashvili-Kardava M., Financial and economic factors of economic security and the mechanisms of its regulation in the conditions of formation of market relations. -TB. 2006 -P. 336

- Shengelia, N. Skhirtladze, socio-economic essence of investments and their new understanding., Zh. «Business and Law», December 2010-P.19-52[schema type=»book» name=»IMPROVING THE INVESTMENT CLIMATE IN GEORGIA» description=»In the article the author discusses the factors affecting the formation of the investment climate and the country’s image. The article discussed in detail and analyzed statistics data of Georgia Department of investments for quite a long period of time. The authors meticulously analyzed the country’s investors, the size of foreign direct investment and the main areas and sectors of the economy, where they were used as well as reviewed the data on investments for the period 2006-2016 years and gave a detailed analysis of the ratio of public and private investment. The authors are convinced that the main requirement of the investment strategy of our country should be — for the preservation of Georgia last word in deciding the admission of foreign investors into the country and maintaining control over the individual spheres and sectors of the economy, where their investments have to be accommodated.» author=»Maia Chechelashvili, Evgeni Baratashvili» publisher=»БАСАРАНОВИЧ ЕКАТЕРИНА» pubdate=»2017-02-15″ edition=»ЕВРАЗИЙСКИЙ СОЮЗ УЧЕНЫХ_30.01.2017_1(34)» ebook=»yes» ]