Introduction

For Kazakhstan creating effective system of housing finance remains the state and financial problem today. Prior to the beginning of reforms after gaining Kazakhstan the independence, housing finance conducted centrally: main sources of the housing stock of the country were public housing and housing constructed by companies and organizations, while cooperative individual building played a supporting role. The main source of housing finance in Kazakhstan was the state budget.

With transition to a market economy, approach has changed: now the population, except for certain social groups itself, must take care of buying a home. This is the only real opportunity to improve living conditions for the majority of citizens. The problem associated with the accumulation of financial resources is sources of investment.

Analysis of research

Problems of development, essence, factors affecting the real estate market as a whole and its component parts have been covered in the works of Kazakh scientists Kulumbetova L.B. [1], S. Bolatkyzy [2], Zhumanazarova G.M. [3], Kazieva A.K. [4], Konysbaeva A.A. [5] and others. Studies, conducted by Russian scientists Polyakov L.A. [6], Sergeev A.S. [7] and foreign economists Helmut Jenkis [8], Gurley J.G. and Shaw E.S. [9], R. Heaney, S. Sriananthakumar [10], Bradley T.E., James E.P. [11], Stanley M., Cooper D., Ring A. [12], Bradley T.E., James E.P. [16], in the theory and practice of market relations confirm that funding sources can be considered in different ways: from the point of view of the types of sources of financial resources (state funds and private funds); the perspective of investment in the housing sector (housing construction, renovation, buying a home).

Helmut Jenkis [8] believes that in the process of housing finance there are three sources of funding [8; p.2-22]. Among possible sources are government (budget) resources and private resources, which include own funds of enterprises and citizens, loan proceeds. The author relates loan proceeds to the third independent source.

- Public funds are mainly represented by financing from the state budget. Gurley J.G. and E.S. Shaw [9], for example, emphasize funding through government subventions, when decision on subsidizing housing sector can be made within the public policy, including the burden on the state budget. Indirect subsidy can be expressed, for example, by the possibility of deducting the interest for the loan from the tax base. On this basis, the two phases are distinguished:

- a) Subsidizing phase of prior accumulation of funds for the purchase of property;

- b) Subsidizing the accumulation phase of funds after the purchase of property needed for repayment of loans for this purpose.

The first option is the most appropriate one because it encourages those, who wish to purchase housing, to create preliminary savings for this. Availability of preliminary savings to reduce the amount of loan proceeds required and, consequently, allows insuring the borrower against the risk of insolvency and inability to pay the loans and interest thereon.

The second option, in contrast, promotes the accumulation of debts. When choosing a method of subsidizing one needs to consider the procedure of taxation in the country. the second method is also applicable if the rate of income tax is fixed, since in this case there is no discrimination of groups with lower income.

- Gurley J.G. and E.S. Shaw [9], noting the non-state resources, focus on: the financing of own funds, which implies the formation of savings (financial resources) prior to investing, in this case it is possible to talk about the target stocks. This accumulation is formed by the income which is not spent on the current consumption. Real estate financing (housing) exclusively at its own expense is possible only in a limited number of cases, due to the relatively high cost of real estate. However, availability of own funds in the amount of at least 20-30% of the cost of housing is a prerequisite in almost any state. Availability of own funds to purchase housing designed to limit the potential risk of the borrower in the event of adverse economic changes. The higher own funds, the lower the required amount of the loan and the less interest for the loan will be paid in the future.

- Highlighting separately loan proceeds, it should be noted that funding by loan proceeds is related to the high cost of real estate, therefore in most cases, there is a need to buy a home using loan proceeds. In the scientific literature [3] there are two basic models of financing the purchase of property:

- a) Funding through the loan. This method involves first receiving of the loan, and then the purchase of housing, with subsequent payment of received loans with interest. The loan is paid by the borrower after the purchase of property. This method is called «Principle of subsequent savings» in the Western literature, because the person accumulates savings and makes payments on the loan in a subsequent time period. The most common type is mortgage lending. Such a system of credit is open, as investors are not borrowers at the same time.

- b) Funding, this consists of the initial accumulation of the required amount and then receiving the lacking sum in the form of loan at low interest rates. This method is called «Principle of prior savings» in the Western literature. This system is closed, as the person, who accumulates funds in savings accounts, will be the recipients of the loan later. An example of such a model can serve as a financing housing construction fund of the German model. This method of financing housing is cheaper for those wishing to purchase housing, rather than the first model.

Current trends of financing housing sector

Today, non-financial resources are in priority, including loan sources for the market relations in Kazakhstan. Budgetary funds may be used already as a basis for extra budgetary funds. Public funds in Kazakhstan will now be directed primarily to the implementation of the program of social housing for those categories of citizens who are legally supposed to have free housing. Built apartments will continue to be provided to citizens in a queue and conditions of employment. The volume of this building is small; therefore the housing problem is not significantly weakened [1, p. 182]. Allocation of budgetary resources to encourage investment in housing, even in a small amount, can be a catalyst for financial and investment process.

The government of the RK accepted the program «Available housing — 2020».For providing with affordable housing of the main part of the population of Kazakhstan. Strategy of implementation of the state program on the next fifth anniversary is based on the principle of establishment of the basic fixed tariffs for square meter of affordable housing for the certain city, the region. Such approach of planning of construction demands to bring adjustments to tariffs external factors.

The state tariffs have the fixed character. In this regard the question of an assessment of a deviation of the real prices from the tariff prices is actual. Such problem definition allows to determine the real maximum quantity of affordable housing by each of types and to distribute resources in the best way.

Nevertheless it should be noted that the main cause of a complex state of the funding the vital sectors of the economy (housing) is the lack of a working mechanism of formation of monetary resources — «long» money for investment in the housing sector. Even understanding the special value of housing problem for Kazakhstan existing inflationary expectations, the risk of long-term investments and undeveloped state regulation mechanism in the formation of the housing market prevent its expansion. It should be recognized that in recent years, Kazakhstan has accumulated considerable experience in attraction of financial resources of public and enterprises in the sphere of housing construction. Many large corporations and joint stock companies show initiative. Connecting state and commercial interests will give lacking impulse to force the widespread housing. In addition, this priority will be clear to the people and provide support for it.

According to the Regulations of attraction of the population’s financial resources to the housing savings and loan accounts two main types were distinguished: simple (simple savings) and specific accounts [3, p. 63].

The purpose of the housing finance system is expanding opportunities for the acquisition of property by the employable population. Achieving this objective is delivered by creating favorable conditions of markets for lending to citizens to purchase housing. Development of the housing finance system is considered as a priority housing policy of Kazakhstan. This means that the main efforts will be focused on solving the housing problems of the population with stable income and who want to solve the problem of improving housing conditions on their own, without financial assistance from the state. However, function of providing housing on the conditions of social or commercial hiring, gratuitous use for those citizens whose incomes do not allow them to buy housing even with a long-term loan, will remain over the state.

Materials and methods

Research of the Russian Academy of investment and construction economy is worth to note, lies in four systems on justification of housing finance, each of which has certain advantages, focused on the specific terms of consumers, which is additional to the «direct» methods of housing finance and do not oppose to the laws of the country on Housing [6, p. 38]:

- System with major public and commercial mortgage corporation.

- System of forming investment resources with the involvement of employers of the customer.

- System of providing the state guarantees to the commercial banks and housing finance.

- System of improving the efficiency of social construction.

Below the features of each of the 4 systems are introduced.

The first system — Mortgage Corporation is organized, which works in conjunction with local authorities. It considers applications for funding housing projects, acts as a state customer, places an order for the construction between contractors. Mortgage Corporation places investors’ bonds (fixed-date and indefinite — savings) that can be sold on the secondary market. Upon completion of the construction contractor transmits built housing to the Mortgage Corporation, which realizes repayment annuities or providing a mortgage loan through an authorized bank, reflecting the interests of all stakeholders, especially credit borrowers [6, p. 39].

The second system — formation of investment resources is due to transfers to private retirement accounts of employees for a certain period (2-2.5 years). State may legally attribute to the first cost part of the funds allocated for the completion of personal retirement accounts. Banks open special account for this purpose and may use the proceeds only for housing [6, p. 41].

The third system — linked to the provision of state guarantees and benefits to the investors in the construction industry. In the form of strict liability, the state includes the funds allocated by the bank to finance housing construction in the domestic public debt and is ready to repay the money if the bank will not be able to return the resources in certain circumstances. Scope of the risks, protected by the guarantee, must be accurately determined in the interests of the state. It is also possible to provide special program of state guarantees to local authorities on the development of housing [6, p. 42].

The fourth system — aimed at increasing efficient use of budgetary funds allocated for social housing. Authorized bank implements factoring of the payments of a construction company, which has received a contract on tender. The main aspect is starting price of construction, calculated from the average cost and the average profitability of the project in order to save investment resources which are budgetary resources [6, p. 45].

Analyzing the parts of each of the systems, it should be noted that they are basically realistic; moreover social aspect is presented in the mechanism of their realization in addition to all the market regulators and tools. In each of the methods actions and interests of commercial banks, construction contractors, and the role of state and local governments are presented clearly enough. The most important thing in these methods is the ability to use all kinds of financial resources (budget, investors, private pension savings, funds of employers, banks’ capital) based on the development of a specific mechanism for the flow of financial resources to housing. It is encouraging that the methods focuses on strengthening the government’s housing policy, focus on the management of local budget funds and focus on buying quality housing, as well as on the development of the mortgage lending.

Authors’ vision can be justified by comparative analysis of macroeconomic indicators in the field of socio-economic development of the Republic of Kazakhstan in connection with the performance of the housing market for a specified period, assuming that processes in the economy, positive trends in financial and social spheres are the basis for the development of housing construction industry and this is confirmed in table 1.

Table 1

Comparative analysis of macroeconomic indicators of socio-economic development of the Republic of Kazakhstan in connection with the development of the housing sector

| Indicators | January-July 2014 to January-July 2013 | Comments on the level of growth and verification of the actual impact to the current date (early 2013)

|

| 1 | 2 | 3 |

| 1. Real GDP growth | 106,0 | Growth has a positive impact |

| 2. Consumer price index, including

paid services |

104,8 | Growth has a negative impact |

| 3. Price index for construction (end of period, to December of the previous year) | 103,3 | Growth affects the estimated cost of construction |

| 4. Industrial production volume | 102,3 | Growth has a positive impact |

| 5. Gross output of agriculture | 110,8 | No strong influence |

| 6. Total volume of cargo/transportation | 103,8 | No strong influence |

| 7. Retail turnover volume | 112,8 | Growth has a positive impact |

| 8. Volume of investments in fixed assets | 106,5 | Effect is not strong yet |

| 9. External turnover, including export and import | 98,9

95,4 105,4 |

Growth has a positive impact |

| 10. Revenues to the state budget | 45,3 | Growth has a positive impact |

| 11. Expense of the state budget | 60,7 | Positive impact |

| 12. Deposits in the banking system, including deposits (deposits) of the population | 49,2

47,3 |

Growth has a positive impact |

| 13. CTB investments in industries, including long-term loans to construction |

63,8

77,6 |

Growth has a positive impact |

| 14. Money supply (M3) | 47,5 | Growth has a positive impact |

| 15.Average nominal income | 109,012 | Need to raise |

| 16. Real cash income | 103,0 | Need to raise |

| 17. Proportion of population with incomes below the subsistence minimum, percent | 3,1 | Effect is not strong yet |

| 18. Real wage | 101,6 | Need to raise |

| 19. Construction works | 103,0 | Out of 410,2 bln.tg – 78,2% — private constr. companies; state organizations – 0,8% |

| 20. Investment in housing | 1,4 times | Volume of 154,1 bln.tg |

| 21. Commissioned houses, total area | 101,5 | 6,9 mln.sq.m. |

| 22. Average actual construction cost of 1 sq. m of total housing areas | 11,7 | January-July 2013 – 186 thousand tg |

Certainly, main macroeconomic indicators show housing development, while the effect of the degree of their relationship is even more obvious. Such indicators as: volume of state budget revenues, expenditures of the state budget, deposits and loans, real incomes and wages are the fundamental sources of fundamental housing development in the country. Indicators of housing development in 2007 confirm further growth [5, p. 56].

The task of providing a sufficient quantity of housing, affordable by price or method of purchase of house is one of the determining factors of social policy for any state. It is therefore very timely implementing national quality and affordable housing construction programs at public expense with developing public housing programs. Thus, financial resources regardless of its type (budget, own funds or loan proceeds), which should develop the housing sector of Kazakhstan, remain the main factors of housing construction.

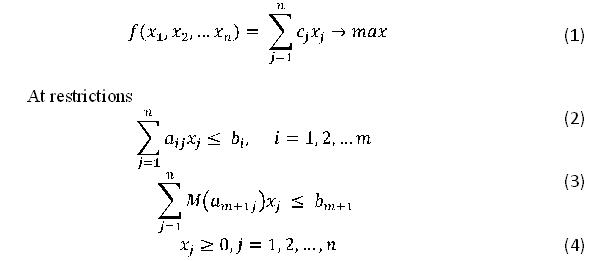

For formalization of optimizing econometric model we will enter the following designations and the aggregated indicators.

n— quantity of types of the affordable housing;

m— quantity used in construction production resources;

aij— specific expenses of i resource necessary for construction of one square meter of j type of housing i= 1, 2,…,m; j= 1, 2,…,n;

bi— available stocks of i resource i= 1, 2,…,m;

cj— income gained from construction and realization of one square meter of j type of housing;

m+1— number of the financial resources allocated for all types of housing of affordable housing;

am+1j— specific tariff allocated with the state on square meter of affordable housing of j— type;

bm+1— the volume of the financial resources allocated for all types of housing:

M[am+1j]— the expectation of a random variable that satisfies the normal distribution am + 1j ;

xj— number of the constructed and realized square meters of housing of j type, j= 1, 2, …, n.

Then the optimizing econometric model for maximizing the income from construction of n of types of housing, at the best use of all having resources, looks like:

To find a vector x = (x1, x2, …, xn), the delivering maximum income

In model:

(1) — the criterion function characterizing the maximum income from realization of built houses;

(2) — system from m-of the restrictions, corresponding to construction technology;

(3) — econometric inequality characterizing the real prices by each type of housing;

(4) — x = (x1, x2, …, xn) — the program of construction of n of types of affordable housing.

In presenting the above it can be concluded that, without taking into account external factors may increase the risk factors for house prices. During the analysis, it was revealed deviations from the price does not meet the basic fixed rates per square meter.

Results and discussion

The current situation in the housing sector of Kazakhstan requires a thorough analysis of theoretical generalization of the experience of financing and lending, a detailed study of the functioning and transformation the credit and financial system and investment in terms of economic reforms. Housing in Kazakhstan continues to be the main focus for investment. The housing market in a short time has grown to a developed industry with enormous growth of all its component elements from investments to construction. Against this background, at the same time, overheating economy factors and various risks, faced by all participants, including financial institutions and banks, are of particular concerns.

To assess the situation in the housing sector it is appropriate to examine the history of housing sector; provide housing needs in our country with illustrating the funding sources with an aim of confirming the role of financial resources. Periods of housing development can be divided into several stages, taking into account the last century (Table 2):

Table 2

Characteristic periods of housing construction and its source

| Stages

(Years) |

Types of housing under construction

and their characteristics |

Funding sources |

| 30-50 | Barrack types for workers, 2-4-storey brick houses on individual projects (on a turnkey basis) | State budget and own resources of large industrial enterprises

|

| 50-80 | Panel, compact 5-storey building («Khrushchev houses») (on a turnkey basis) | State budget and share participation of enterprises |

| 80-90 | Large high-rise buildings of the state and cooperative sectors (on a turnkey basis) | State budget, share participation of enterprises and funds of cooperatives |

| 90-2000 | Minor construction of private and individual property | Private capital of individual owners, reduction (lack of) budget |

| From 2000 onwards | Development of non-residential construction with the transition to various projects (economy, business and elite class) (surrender of the draft with subsequent alteration and turn-key), joining of public sector | Private capital of construction companies, (own) with equity participation. Bank loans (mortgage), individual savings of individual citizens. Involvement of the state budget — budget funding and budgetary lending |

Analyzing these periods, it can be concluded that the state considered the problem at all stages and implemented programs of housing development and eventually improved housing, upgraded, met the criteria for the needs of different social layers of the country. However, comparing the development of common approaches to the housing sector in Kazakhstan in a planned economy and after the transition to a market economy, we can confirm the differences and diversity in the mechanism of financial support for housing construction, methods of financing and implementation of housing programs.

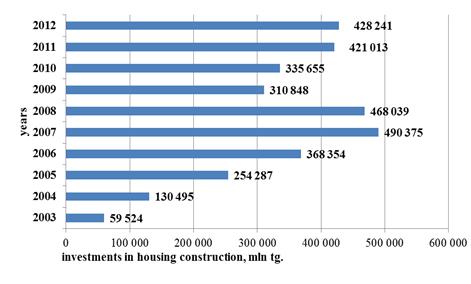

Investment in housing construction in the pre-reform period was primarily from the state budget on the basis of approved plans. And in a market economy investment in housing is a set of costs, realized in the form of long-term investments by private or public capital, pursue profit in shorter terms, while investments are paying off after a considerable period after the investment [2, p.229]. Tracing the economic growth in the country, the growth of individual sectors, including the field of housing, it is possible to present in conjunction the main indicators of socio-economic development, that are somehow related to housing. Overall picture can be traced in dynamics for 2008-2012, according to the Statistical Yearbook of the Statistics Agency [4, 91]: GDP 2 times, investment in fixed assets grew 2 times, volume of performed construction work — 1.9 times; commissioning housing — 3.1 times, the growth of average nominal wages of the population — 1.7 times, growth of household savings (retail deposits) — 2.3 times, long-term loans of STB — 4.5 times, including the construction sector — 3.7 times.

Figure 1 — Volume of investment in housing.

As it can be seen from the figure, investment increased more than seven times and Astana remains the leader among the cities of Kazakhstan. Based on these facts it is clear that investment, both public and commercial, will only grow. However, the fact that many real estate transactions are made in the informal economy, without reflecting the real sums, or through cash, is not taken into account. Such turnovers are difficult to control and take into account in the statistics. Therefore, for banks it is very difficult to promote mortgage lending programs, especially in commercial real estate segments.

Reforms undertaken by the Kazakh authorities allowed the country in a relatively short period of time firmly occupy the position of the country with a stable economic and social situation, and create favorable conditions for attracting capital and investment.

Annual GDP growth in the range of 9-10%, allows conclude that Kazakhstan is one of the most dynamic and favorable for capital allocation countries. Consequently, the expansion of investment demand is confirmed. Moreover, it will be primarily due to the internal sources of investment financing obtained by enterprises’ own funds.

Conclusion

In addressing the current housing problem with an aim to open the access to housing, Kazakhstan started to use different mechanisms for financing housing construction. Changes in the economic and social order of the country required the replacement of traditional public funding sources that form the basis of housing investment in pre-reform era, and the introduction of new investment instruments. The Government program doesn’t consider the real price, and construction companies can not build in fixed price, which were approved by Government, and they have to look for additional finance.

The study of the theory of financial relations in the sphere of housing construction and investment process as a whole, financial, legal and organizational aspects as well as the compilation of international experience allows us to conclude the housing sector of Kazakhstan and the state of its finances. Recognition of the independence of financial and investment process in the housing sector of the Republic of Kazakhstan, undoubtedly, requires justification as a concept.

As a result of analysis of the current state of the housing sector in Kazakhstan by the funding sources, conclusions about the need to improve funding mechanisms were made in this study. The main reason of a complex state is a lack of operating mechanism of formation of financial resources for investment. As shown in the analysis of macroeconomic indicators of socio-economic development of Kazakhstan, there are all grounds for the implementation of systems of financing offered by the Russian economists, which will complement the «direct» methods of housing finance.

References:

- Kulumbetova L.B. Stages and development trends of the housing market in Kazakhstan / / Bulletin of KazATC. — 2007. — № 4. — p.181-187.

- Bolatkyzy C. Formation and development of residential and commercial property in Kazakhstan: dissertation. Candidate of economic sciences… (KyzSU) named after Korkyt-Ata. — Kyzylorda, 2010.-137 p.

- Zhumanazarova G.M. Prediction and evaluation of factors affecting cost of estate in the RK: dissertation. Candidate of economic sciences…: 08.00.05. — Almaty, 2009.-155 with.

- Kazieva A.K. Efficiency of investment decisions in the construction industry in Kazakhstan: dissertation. Candidate of economic sciences. — Almaty, 2010. — 133.

- Konysbaeva A.A. State of the housing market (based on the materials of Mangistau region) [electronic resource]: dissertation. Candidate of economic sciences. — Almaty, 2009. — 120.

- Polyakov L.A. Multiplier theory and economic mechanism of regulation of the housing market: dissertation. Candidate of economic sciences. — Yaroslavl: YSU named after Y.G. Demidova, 2000.

- Sergeev A.S. Housing Finance in Russia: dissertation. Candidate of economic sciences. — Novosibirsk, 2002.

- Jenkis «Grundlagen der Wohnungsbaufinanzierung» Oldenbourg, Munchen, 1995. — S.2

- Gurley, J.G. and E.S. Shaw (1967) «Financial Development and Economic Development» Economic Development and Cultural Change vol.15, no.3, April : 257-268

- R. Heaney, S. Sriananthakumar Time-varying correlation between stock market returns and real estate returns / / Journal of empirical finance.-2012. — № 24. P.12-24

- Bradley T.E., James E.P. The response of real estate investment trust returns to macroeconomic shocks / / Journal of Business Research. — 2005. — № 58. P. 293-300

- Stanley Morgan, Cooper D., Ring A. The Improvement of National Housing System / / Deloitte Discussion Papers.-2005. — № 5.-R.15-19

- Bradley T.E., James E.P. The response of real estate investment trust returns to macroeconomic shocks / / Journal of Business Research. — 2005. — № 58. P. 293-300

- S.K. Kondybayeva, Zh. Sh. Ishuova. The effect of monetary policy on real house price growth in the Republic of Kazakhstan: a vector autoregression analysis / / World Applied Sciences Journal. — 2013. — № .22 (10).-P. 1384-1394.[schema type=»book» name=»OPTIMIZING ECONOMETRIC MODEL AS INNOVATIVE DEVELOPING INSTRUMENT OF FINANCIAL AND INVESTMENT SOURCES OF HOUSING SECTOR» description=»The purpose of the article is to identify the problem of development of financial and investment sources of the housing sector of the Republic of Kazakhstan. The article analysis the current state of the housing sector in Kazakhstan, the research offering optimizing econometric model as innovative instrument of the funding mechanisms in housing sector. The optimizing econometric model will give opportunity to consider a real price, so that the construction companies could exactly forecast expenditure for building.» author=»Kondybayeva Saltanat, Ospanov Serik, Sadykhanova Gulnar» publisher=»БАСАРАНОВИЧ ЕКАТЕРИНА» pubdate=»2017-01-26″ edition=»ЕВРАЗИЙСКИЙ СОЮЗ УЧЕНЫХ_31.10.15_10(19)» ebook=»yes» ]