Before characterizing the leasing market in Georgia, we note that in this market as sellers of fixed assets under lease are the 38 leasing companies. The State Department for Statistics of Georgia in its service combines both financial and operational leasing, as well as the usual rent, or lease of real estate (apartments, offices, cottages, etc.), which in our opinion is wrong.[2;12]

With this approach, the volume of leasing services artificially inflated, and is as follows: in 2010 — 12,573.5 thousand GEL, in 2011 — 20,982.4 thousand GEL, in 2012 — 21,959.9 thousand GEL, in 2013 — 26585, 4 thousand GEL and in 2014 — 33237.7 (see table 1). If we subtract the cost of surrendered own property, which is a conventional rent, rather than leasing, we obtain the true value of leasing transactions (the volume of the leasing market). The same table shows that it is as follows: in 2010 — 3567.1 thousand GEL, in 2011 — 4525.2 thousand GEL, in 2012 — 4949.8 thousand GEL, in 2013 — 7079.2 thousand GEL and in 2014 — 9400 thousand GEL. Consequently, the real leasing market is lagging behind in its scope from the usual market rent is almost 3 times, although the development dynamics of the same, both grew equally — in 2,6 times.[1;3]

Table 1

The Amount Handed Over Leasing and Leased Property in Georgia[3;13]

| 2010 | 2011 | 2012 | 2013 | 2014 | |

| Total | 12 573,5 | 20 982,4 | 21 959,9 | 26 585,4 | 33 237,7 |

| Including Rental of

Own Real Estate |

9 006,4 | 16 757,2 | 17 010,1 | 19 506,1 | 23 837,7 |

| Property Leasing | 3 567,1 | 4 225,2 | 4 949,8 | 7 079,2 | 9 400,0 |

There is a view only valid leases (both financial and operational) and, in contrast to the department of statistics, it is not identified with the usual rental property.

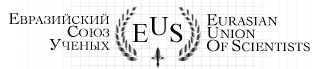

Table 2 and Figure 1 show calculated in that order in the total turnover of the leasing market in 2014 the first and second place was occupied by leasing passenger cars (45.5%) and leasing of trucks and passenger cars (30.8%).Third place with a share of 15.1% occupied by construction machines and equipment. It should be noted that in 2010 the operations of leasing of construction machinery and equipment is not generally carried out. In the period of 2011-2013 biennium it is represented by a small fraction. Recorded in 2014 a high percentage indicates that the industry is growing rapidly, which is much of the country and visually (dozens of new homes are built only in Tbilisi). [3; 3]

In 2010 the proportion was lower freight and passenger cars (8.5%) in the leasing turnover, which reached 30.8% in 2014. The trend of reducing the proportion manifested itself in the construction equipment leasing (3.8% instead of 6.8% in 2010), in the proportion of leasing of office equipment and computers (1.7% instead of 4.7% in 2010) and in the proportion of agricultural machines (0 1% instead of 0.7% in the 2010 year). As for water transport (ships, boats), there was no lease at all.[3;12]

In all countries, particularly developing countries, small and medium enterprises helps government — giving them free technology, equipment, reduces taxes, etc.

Table 2

The Structure of the Trade Turnover of Georgia Leasing Market by Type of Leasing Object [3;21]

| 2010 | 2011 | 2012 | 2013 | 2014 | |||||||

| Volume (thous. GEL) | Share (%) | Volume (thous. GEL) | Share (%) | Volume (thous. GEL) | Share (%) | Volume (thous. GEL) | Share (%) | Volume (thous. GEL) | Share (%) | ||

| Industrial Equipment | 241,7 | 6,8 | — | — | — | — | 26,5 | 0,4 | 360,7 | 3,8 | |

| Cars | 2343,6 | 65,7 | 1582,2 | 37,4 | 2812,9 | 56,8 | 2504,3 | 35,4 | 4265,1 | 45,4 | |

| Trucks | 303,2 | 8,5 | 2103,5 | 50,0 | 1385,4 | 28,0 | 3887 | 54,9 | 2895,1 | 30,8 | |

| Equipment for Water Transport | 483,5 | 13,5 | 253,1 | 6,0 | 468,7 | 9,5 | 371,1 | 52 | — | — | |

| Agreecultural Machines. Agreecultural Equipment | 25,1 | 0,7 | 212 | 0,5 | 12,4 | 0,2 | 19,8 | 0,3 | 12,8 | 0,1 | |

| Construction Machinery and Equipment | — | — | 10 | 0,2 | 11,3 | 0,2 | 6,6 | 0,1 | 1420,5 | 15,1 | |

| Office Equipment and Computers | 167,1 | 4,7 | 132,2 | 3,1 | 136,4 | 2,7 | 139,3 | 2,0 | 161,4 | 1,7 | |

| All the Rest | 29 | 0,1 | 122,8 | 2,8 | 122,7 | 2,5 | 124,7 | 1,7 | 284,4 | 3,0 | |

| Total | 3567,1 | 100,0 | 4522,2 | 100,0 | 4949,8 | 100,0 | 7079,2 | 100,0 | 9400,0 | 100,0 | |

In Georgia, no such aid small and medium-sized enterprises from the state do not receive. Our proposal is that small businesses manufacturing of Georgia passed in leasing from the state machinery leasing companies cheaper than large enterprises, or for free.

2010 2014

Figure 1. Structure of Turnover Georgian Leasing Market by Type of Leasing Projects in 2010, 2014 [3;9]

To evaluate the specific structure of the Georgian leasing market turnover, we compared it with a similar structure of the leasing market in Europe. In the European market, industrial equipment occupies 23% of cars — 35% (Georgia — 45.4%), freight and passenger cars — 18% (Georgia — 30.8%), computers and office equipment — 12% (Georgia — 1.7%), planes and cars — 4%, other assets — 5%. These data show that in Georgia, Europe, in the structure of the leasing market is dominated by highly liquid assets in the first place it is cars, passenger and freight cars. This is a kind of fear that if the lessee upon the expiration of the contract did not buy before the end of the property taken on lease and return it back to the lessor in this case be able to without difficulty a second pass (sell), and because there is always a great demand for both passenger as well on the freight and passenger transport, leasing companies tend to have in the back of their greater number. [3;18]

Among the potential recipients of leasing is primarily thought of small and medium-sized enterprises, and only then — large. This conclusion is made from leasing practices in developed countries. For example, Georgia is not yet confirmed.

Table №3

The Structure of the Trade Turnover of Georgia Leasing Market in the Number of Company-lessees [3;14]

| Total |

Including |

|||

| Large enterprises | Medium-sized enterprises | Small business | ||

|

2010 Volume in th. GEL Share (%) |

3567,1

100,0 |

2981,5

83 |

585,6 17 |

|

| 2011 Volume in th. GEL

Share (%) |

4225,2

100,0 |

1918,8

45,4 |

2306,4 54,6 |

|

|

2012 Volume in th. GEL Share (%) |

4949,8

100,0 |

2682,2

54,2 |

859,4

17,4 |

3567,1 100,0 |

|

2013 Volume in th. GEL Share (%) |

7079,2

100,0 |

4316,6

60,9 |

2158,4

30,5 |

1408,2 28,4 |

|

2014 Volume in th. GEL Share (%) |

9400,0

100,0 |

6593,3

70,0 |

1433,3

15,2 |

1373,4 14,8 |

2010 2014

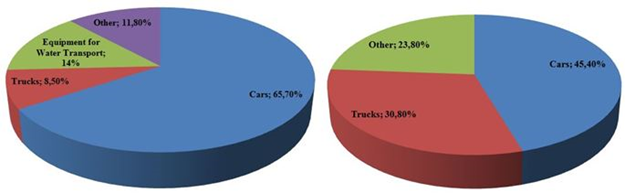

Figure 2. Geographical structure of the leasing market turnover of Georgia for 2000-2004 [3;12]

The Table 3 shows that of the total number of enterprises — Georgian leasing market customers to small businesses accounted for a very small proportion of turnover, especially in 2010 — 17%, in 2011 — 54.6%, in 2012 — 28.4% in 2013 — 8.6% and in 2014 — 14.8%.

Purchasers of property leasing in Georgia are mainly large enterprises. In 2014, they accounted for 70% of turnover. This means that not even matured yet large business entities in Georgia enough to buy equipment on their own funds or bank loans and prefer to receive it in leasing. In the future, apparently, the situation will change, and in Georgia, both in the European countries, the main clients of the leasing market will be the small and medium enterprises.

With regard to the geographical structure of the Georgian leasing market, here we see the following picture (see Table 3 and Figure 2): More than 80% (and 94.5% in 2014) are in Tbilisi, 4.5% — in the Samegrelo-Zemo Svaneti Region (in 2014 — 4.3%), while the other regions do not have even one percent. [3;23]

If we consider the geographical structure of the leasing turnover in dynamics, we see that the share of Tbilisi it has grown significantly (from 83.1% to 94.5%), the share of all the other regions, already small, in 2010-2013 more diminished. This means that undertakings located in the regions, have no financial ability to purchase fixed assets. In our opinion, this provision should be the most interested in regional governments and municipal structures, which can be shared in order to finance leasing operations in the region. Especially it should apply to agricultural machinery.

Creating and updating of fixed assets is an indicator of technological progress than the natural interest of all countries. Of particular importance is the creation of new machinery and equipment and renovation of old, as machinery and equipment are the active part of fixed assets. But Georgia does not have the financial capacity. Therefore, enterprises in Georgia are working with an old, completely or almost completely amortized equipment of Soviet times or foreign obsolete, worn-out equipment.

For the development of the leasing market, we have the following suggestions:

- Exemption from taxes. In our opinion, there is the possibility of obtaining finance lease income deduct from the tax base of leasing companies. This must be done to encourage leasing.

- The introduction of investment tax incentives. This applies to investors who invest capital (investments). Currently, banks have resorted to it in the ground (for example, «TBC Leasing» fully funded «TBC Bank»). In order to expand their investments in leasing activities it is desirable to introduce in Georgia investment tax credits for income earned from these investments.

- Setting the upper and lower boundaries of the leasing fee. In Georgia, there is no uniform method of calculating leasing fees, whereby various leasing firms expect it differently. Of course, each of them tends to get higher fees. Furthermore, to hedge against risk, they require 30-40% fee in the form of an advance. This is holding back the development of the leasing market. To level the action of this factor necessary time to develop the above methodology, which will clear the upper and lower limit of the leasing fee. The upper limit (maximum) should be determined by the average rate of return (in leasing activities), and the bottom — bank interest rate.

- Popularization of leasing. Under this measure, we understand educational activities through newspapers, radio and television. It would be nice to release commemorative sheets explaining the leasing and its advantages.

- Creation of the Association of Leasing Companies. In Georgia, there are 38 leasing companies. But they are not united in the association, and it is necessary because the association — it is such a union, the national association which will defend the rights of each of them, and take care of the development of leasing in Georgia at all.

- Simplify the leasing conditions. Existing leasing companies in Georgia put very strict conditions. As a rule, the Georgian leasing companies begin operations with $ 10,000. 60-70% of the enterprises of Georgia, of course, are not able to execute the lease agreement for 10,000 dollars. Most of them are not able to make even the initial payment for such an expensive lease agreement for their money (we are not talking about the payment of the balance). Therefore, it is necessary that leasing companies have reduced the lower limit of the cost of leasing a commodity transaction.

References

- Georgian Law № 1392 «On the support of leasing activity» of May 7, 2002 / in Georgian / consolidated version is available: https://www.matsne.gov.ge/ka/document/view/16354

- «The new law on leasing activity,» / in Georgian/ is available: https://www.24saati.ge/weekend/story/22129-akhali-kanoni-lizingis-seqtoristvis

- The National Statistics Office of Georgia, is available: https://www.geostat.ge/.[schema type=»book» name=»ANALYSIS OF THE CURRENT DEVELOPMENT OF LEASING IN GEORGIA» description=»The aim of the article is the description of the leasing market in Georgia for 2010-2014. The scientific method selected for writing the work is the analysis, statistical analysis, synthesis, deduction. The result of the study is a description picture of the market of leasing development in Georgia. B Ida findings author suggests five ways to improve leasing relations in the emerging market of Georgia.» author=»Khaliana Chitadze» publisher=»БАСАРАНОВИЧ ЕКАТЕРИНА» pubdate=»2017-01-12″ edition=»ЕВРАЗИЙСКИЙ СОЮЗ УЧЕНЫХ_30.12.16_33(1)» ebook=»yes» ]